When a purchase for the company is completed with a company credit card. First you must go to the main menu along the top to Setup; Purchasing; Purchasing Setup. You must select the following:

Paying with Company Credit Card

When a purchase for the company is completed with a company credit card.

First you must go to the main menu along the top to Setup; Purchasing;

Purchasing Setup. You must select the following:![]()

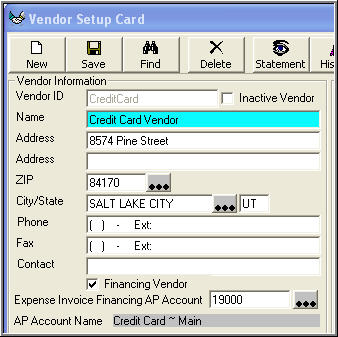

You must setup a General Ledger account to be the value of the credit card. The

GL account type must be one of the these types Accounts Payable, Long Term Debt,

or Current Liability. Next you must setup a Vendor that will represent the

Credit Card. On the Setup of the Vendor Select 'Financing Vendor'. Then Select

the General Ledger account the you setup to track the credit card amount.

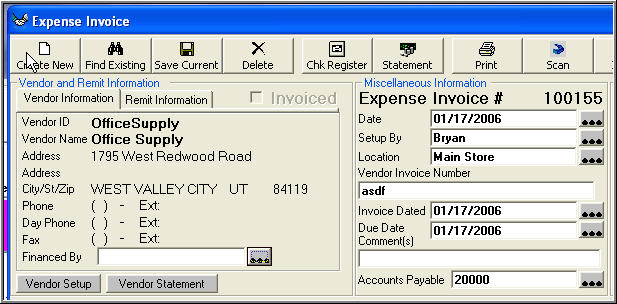

Lets say that John the owner goes and buys pencils. When John gives you the

receipt for the pencils and says he paid with his company credit card. You must

create an expense invoice to enter the expense to office supplies.

When the expense invoice is created it enters the default Accounts Payable (i.e.

20000). If you click on the 3 dots to the right of 'Financed By' in the left

section bottom, a list of all your financing vendors will appear:

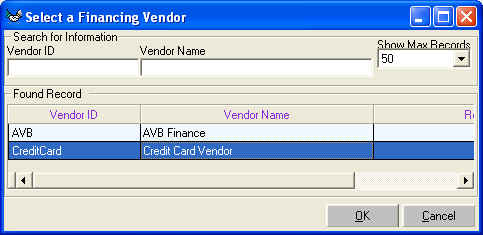

Select your Credit Card Vendor by double-clicking on the line or click 'OK'

Notice the Accounts Payable account will change to what you have entered on the

Vendor 'CreditCard' setup screen.

This expense invoice will then post as follows, Credit account '19000' ~

Credit Card ~ Main and Debit account '63000' ~ Office Expense.

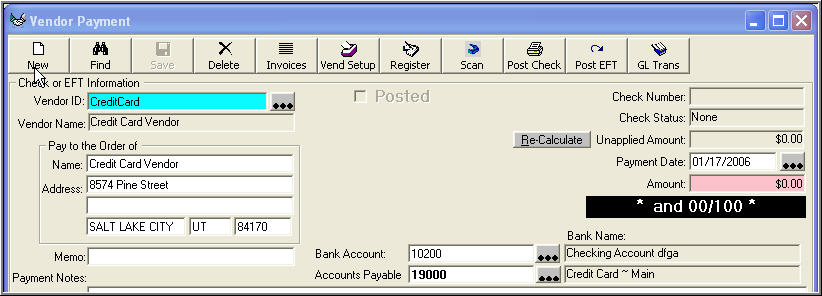

The Next step is to pay the Credit Card. Create a vendor payment and select the

vendor 'CreditCard'

When you create the vendor payment the 'Accounts Payable' account will load automatically

from the vendor setup, therefore 'Accounts Payable' account will load GL Number

'19000' ~ Credit Card ~ Main.

This vendor payment will post as follows, Debit account '19000' ~ Credit

Card ~ Main and Credit account '10200' ~ Checking Account.

Therefore the Account '19000' has been debited and credited. We took the expense

on account '63000' ~ Office Expense and paid the Vendor 'CreditCard' out of our

bank account '10200'