Vendor Adjustments

Purpose:

To make adjustments to a Vendor Account to make it accurate.

How To:

From the Graphical Menu Purchasing

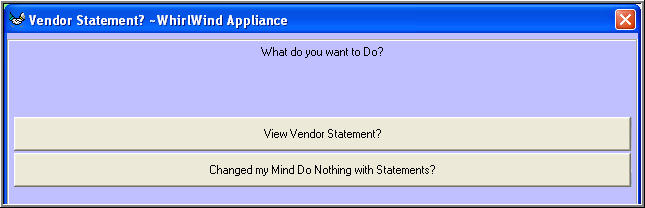

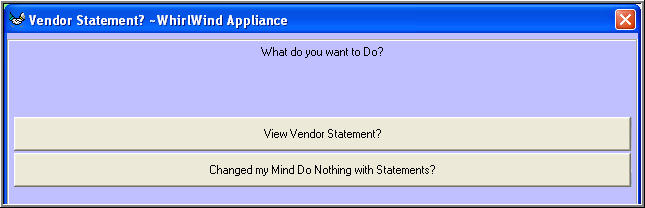

Click on 'Vendor Statement'

Click on 'View Vendor Statement?'

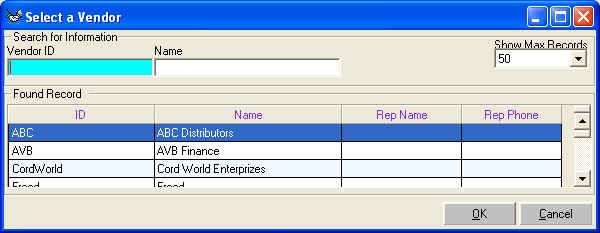

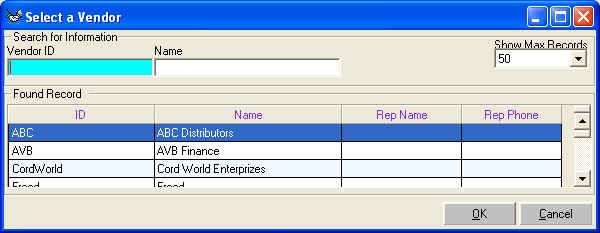

Select the Vendor you want to Adjustment then click on 'OK'

Click on 'Adjust' on the Toolbar of the Vendor Statement

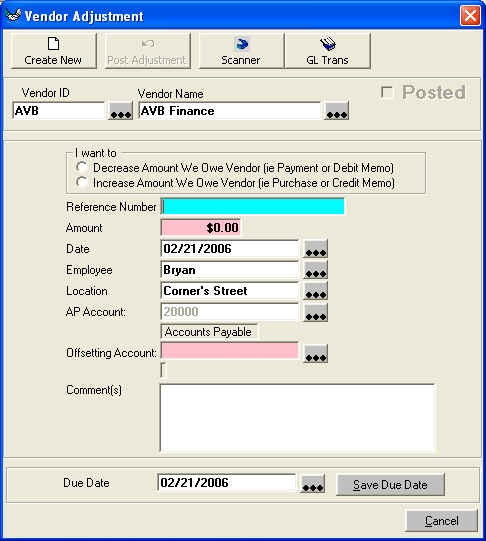

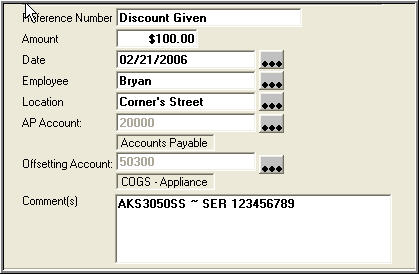

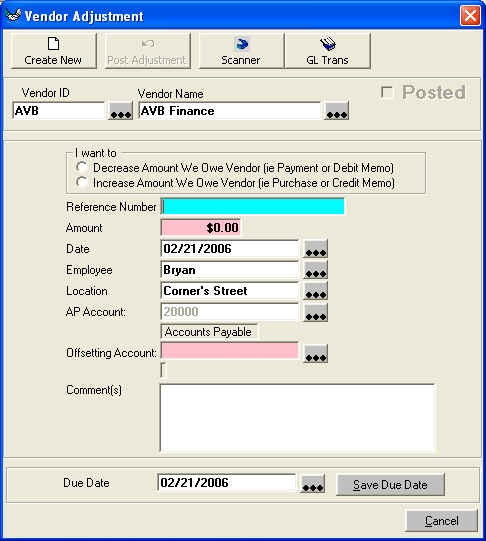

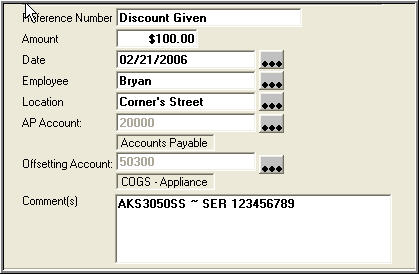

This Screen will appear;

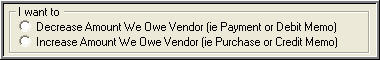

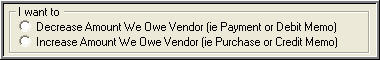

In the Section 'I want to' select if you are going to 'Decrease' or 'Increase'

in the main section

| Reference Number |

The Reference number will appear on the customer

statement |

| Amount |

Enter the Amount of the Adjustment. NO NEGATIVE NUMBERS |

| Date |

Date you want to Adjustment to be Recorded |

| Employee |

Employee creating the Adjustment |

| Location |

This is important for the General Ledger. The AP and

Offsetting Account will be appended to with the Location that is selected

on this line |

| AP Account |

ALWAYS use your Accounts Payable Account Here |

| Offsetting Account |

This is the GL Account that you must select for what you are

making the adjustment for. For example if your vendor is giving you $100

off the price they charged you for merchandise then your Offsetting

Account would be 'Cost of Goods Sold'. There can be many different

accounts for many different reasons. If you have any questions on your

Offsetting Account contact your Accountant. |

| Comment(s) |

This comment can be as long as you want it |

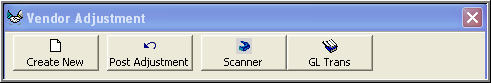

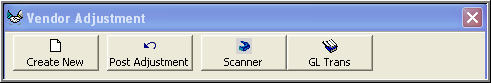

When all the information is answered then click on the Toolbar click 'Post

Adjustment'

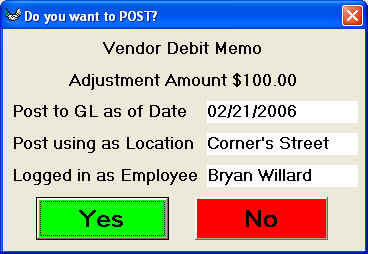

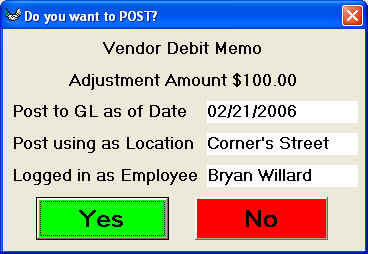

This next screen will appear

If the information is correct then click on 'Yes'

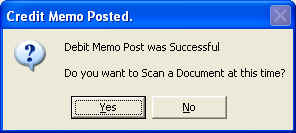

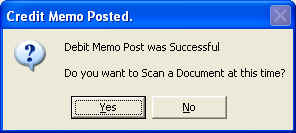

If you want to make a document imaging copy of your source document then click

on 'Yes' on the following screen

You are now done with the Vendor Adustment.

See Also

Apply Vendor Credits

Apply Vendor Debits